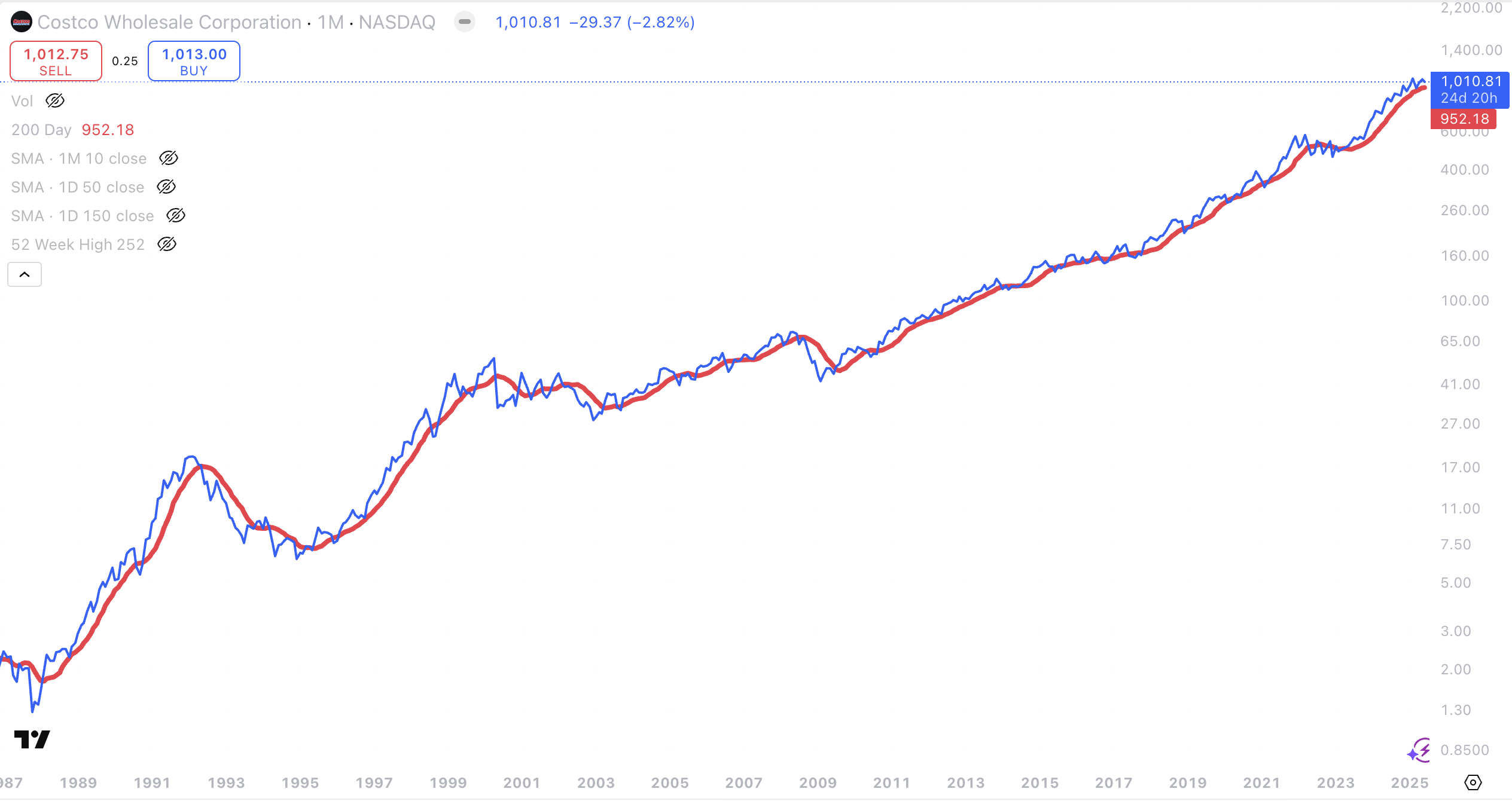

The holy grail of compounding

Scale economics shared is a businesses philosophy that aims to share scale-driven efficiencies in following order: first customers, second employees, and ultimately shareholders—creating enduring competitive advantages. Costco is the best example of a successfull implementation of this philosophy. Costco charges only 15% above cost for its products and shares its growing efficiencies with its stakeholders, increasing customer loyalty and strengthening its competitive moat. Over time, intrinsic value grows significantly, even if the share price can remain stagnant in the short term. Costco share price rose from USD 2 to USD 1000 since 1986 a staggering 400 x multiple. Another examples of company successfully deploying this strategy is Amazon.